All news » National insurance for self employed business

National insurance for self employed business

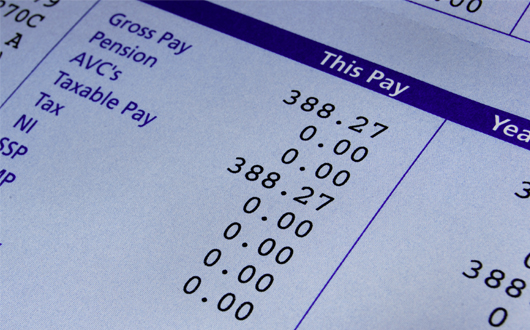

As a self-employed, it is important for you to be informed and to keep track of the contributions you have to pay, so let’s see what types of National Insurances you have to pay and how to calculate the rates.

If you are self-employed you have to pay two types of National Insurance: class 2 National Insurance which is a fixed weekly amount and class 4 National Insurance which is based on your profits. The class 3 national insurance contributions are those that you can pay voluntarily.

If you do not pay national insurance contributions because you cannot work due to unemployment, illness or maternity leave you might receive ‘national insurance credits’. This means that your national insurance contributions are covered for the time that you are receiving those benefits.

Class 2 national insurance

Once you start working as a self employment you are liable to pay Class 2 National Insurance. The class 2 National Insurance contribution of £2.70 per week must be paid by anyone earning more than £5,725per year. For profits of less than £5,725 a year you don’t have to pay any national insurance class 2 or class 4, but you have to apply for Certificate of Small Earnings Exception. You can apply to HMRC for this exception, but even if you are entitled to an exception, you may wish to pay Class 2 National Insurance in order to preserve your pension entitlement.

The National Insurance is usually payable based on your business profits, but there are special rates of Class 2 National Insurance for share fishermen and volunteers.

The class 2 National Insurance can be paid monthly or twice a year by direct debit or in response to payment requests from HMRC. When you register with HMRC, you will be able to set up a direct debit to pay class 2 National Insurance. These class 2 contributions are mandatory but only cover some basic benefits, such as incapacity benefits or a state pension.

Class 4 national insurance

As a self-employed, you must also pay the class 4 contributions which, as opposed to the class 2 contributions, are based on your profit per year.

If your profits are below £7,956 per year (since 2014/15) you don’t have to pay any Class 4 national insurance. If your annual profits between £7,956 and £41,865 you will pay 9% and an additional 2% on any profits above that limit. You have to calculate your class 4 national insurance contributions on your self-assessment and pay them along with your income tax – usually due by 31 January and 31 July each year. You also have to know that if you own more than one business, there are special rules to calculate the adjustments to the amount of insurance you need to pay, for example, if one of your businesses makes a loss.

Generally, if you are self employed, the amount of national insurance you would pay is less than you would pay as an employee. As an employee, around 10 percent of the salary goes to the National Insurance contributions.

Get in touch to find out how we can help you

Tagged in: Uncategorized